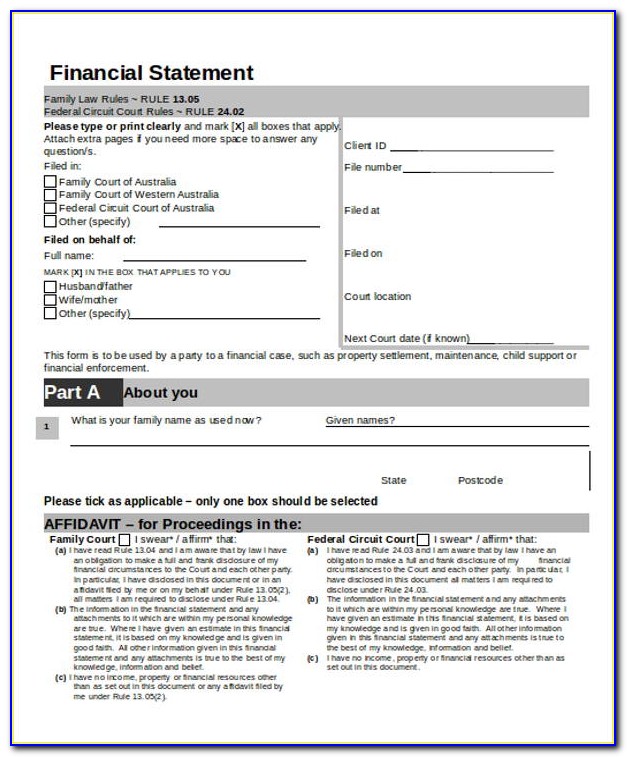

Couples can also use a low-cost online solicitor service. To make sure the consent order is legally binding, it should be drafted by a solicitor. You can find more information on the government website here. Once you have this draft, you need to send signed copies to the court to ask for its approval, which costs £53.

It might also include clauses for child or spousal maintenance. If you agree you can draft what’s known as a consent order which is a legal document that explains how you’re going to divide up assets such as: The value of your ex partner’s pension could be offset against your own retirement savings, or other assets such as the family home.Ĭan we draw up the settlement by ourselves?Ĭouples living in England and Wales can sort out their financial settlement themselves.Part of your ex’s pension pot now, which is transferred into your own pension scheme.Will you continue to pay the premiums? Will the beneficiaries for life insurance change? 3. Or if you have a life insurance policy, you will need to agree how each policy will be dealt with. Try and build up a picture of your current state of affairs and work out:įor example, if you have mortgage together, can one of you afford to keep up with repayments? You should also assess your financial situation, both as individuals and a couple. Check out our article on whether a joint account is a good idea. If you think your ex may go on a spending spree you can seek to freeze your cards. Make sure any wages or benefits go into a new separate account. If you have a joint bank accounts, loans or credit cards, contact your bank or building society as soon as you know you are separating. You need to agree with your ex who gets what and how you will continue to pay your bills. A financial settlement divides savings and property and also covers child maintenance How do I prepare for a financial settlement?īefore you look to reach an agreement, you should sort out your day-to-day finances. This can also be used where the parent liable for payment is particularly wealthy and if there are education expenses to be covered. If a parent who is supposed to pay maintenance lives abroad, you can make an application to the court for a child maintenance order. It will work out how much should be paid, taking into account who the children live with and how much each parent earns. You can either make an arrangement of who pays what between the two of you, or get the Child Maintenance Service involved.

If there are children involved, both parents are expected to pay towards the cost of raising them until they are at least 16. To reach a settlement you also need to consider the division of any debt, loans or credit cards you both have. These are usually protected by a pre-nuptial agreement, if one is in place. The financial assets that were acquired before or after the marriage are considered a non-matrimonial asset. In other words, those that were acquired during the marriage. Non-matrimonial assets are treated differently to matrimonial assets. Financial support such as Child maintenance and Spousal maintenance payments.Find out more about property rights and divorce here. Property, including the family home and any property they own individually.Money, including savings and investments.What you are entitled to in a divorce depends on a number of factors and there are no specific guaranteed entitlements for either party.Įach situation is unique and will be treated as such by the courts, but the type of things you might be entitled to include matrimonial assets such as: What am I entitled to in a divorce settlement?

#Divorce financial settlement how to

Read more here on how to cut the cost of divorce. The law is different in Scotland because you can’t make a claim for financial provision after divorce.ĭivorce law changed in April 2022 but this will not affect the outcome of financial settlements. NOTE: In England and Wales, getting divorced does not end your ability to make any financial claims against the future earnings your ex, or them against you.

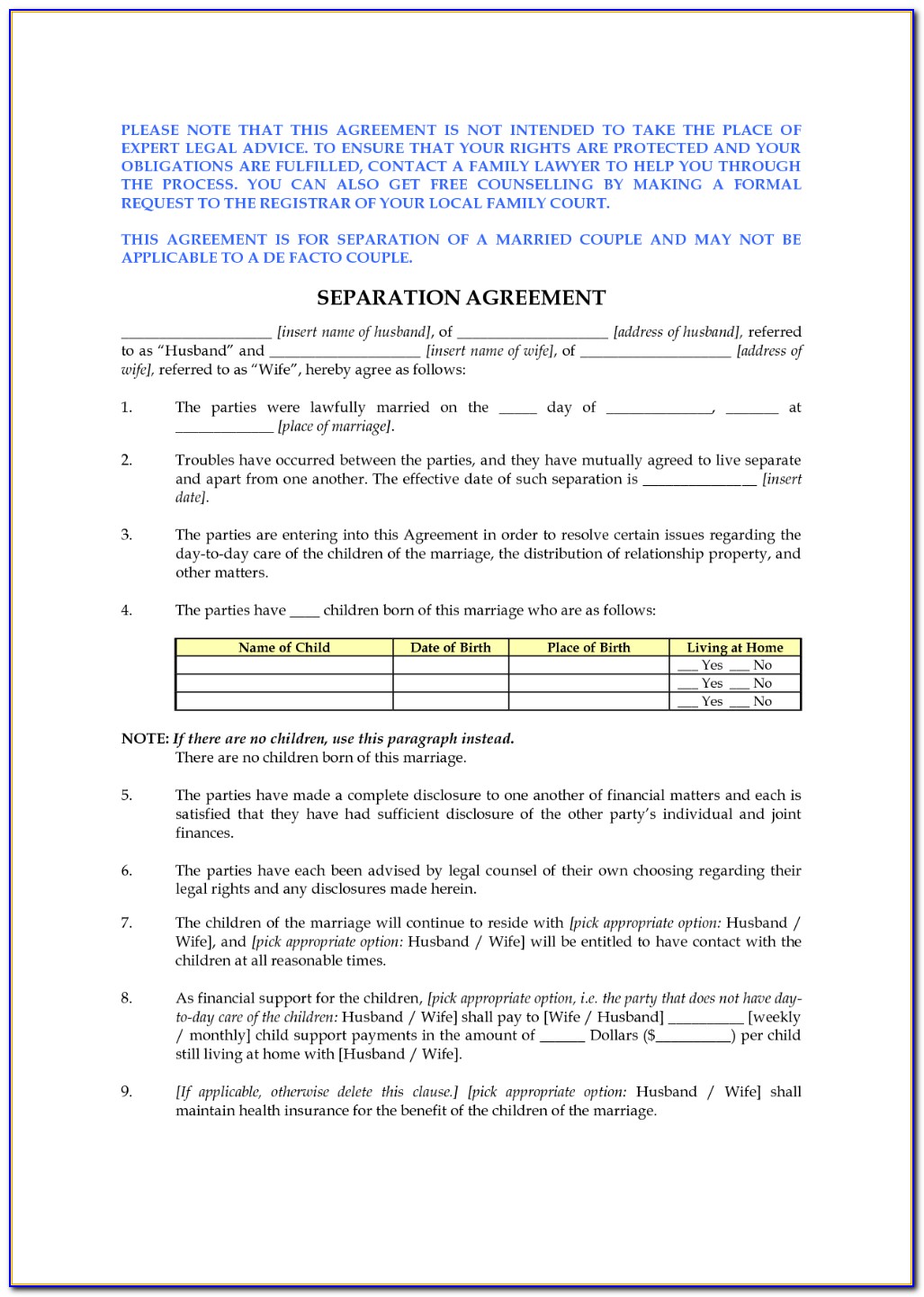

It needs to be approved by a judge, after the first part of the divorce process (decree nisi) has been pronounced. This legal document confirms both parties’ agree on the division of assets. Once you have reached an agreement, a solicitor will draft a consent order to make it legal binding. You can draw one up at any point during divorce proceedings or civil partnership dissolution. A financial divorce settlement is an agreement between you and your ex on how to separate your money and assets once the marriage is over.

0 kommentar(er)

0 kommentar(er)